CRE lifecycle asset management represents a dynamic approach that encapsulates the entire journey of commercial real estate from inception to disposal. As the real estate sector evolves, understanding this lifecycle is essential for stakeholders looking to navigate the complexities of investment, management, and sustainability effectively.

By delving into the various stages of the CRE lifecycle, the role of technology, and current market trends, we can uncover valuable insights that define successful asset management strategies. This exploration is crucial for investors, property managers, and anyone involved in the real estate market.

Overview of CRE Lifecycle Asset Management

Commercial Real Estate (CRE) lifecycle asset management is a comprehensive approach to managing real estate assets throughout their entire lifecycle, from acquisition to disposition. This process is crucial as it helps investors maximize the value and return on their investments while ensuring sustainability and compliance with regulations.The CRE lifecycle consists of several stages, each playing a vital role in the overall management of real estate assets.

These stages include planning, acquisition, operation, maintenance, and disposition. Each phase contributes to strategic decision-making and informs stakeholders about the asset’s performance and potential.Key players in the CRE lifecycle asset management process include property managers, asset managers, real estate investment trusts (REITs), and investors. Their collaboration is essential for addressing challenges and optimizing asset performance throughout its lifecycle.

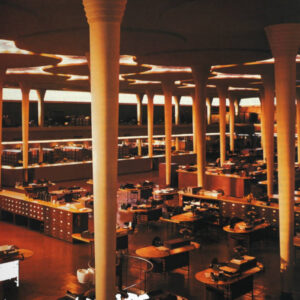

Role of Technology in CRE Lifecycle Asset Management

Technology is revolutionizing asset management practices in the real estate sector by enabling better data analysis, enhancing communication, and improving operational efficiency. With the integration of advanced software and data analytics, asset managers can make more informed decisions based on real-time data.Smart home technologies are significantly impacting property management, offering features such as remote monitoring, energy management, and enhanced security systems.

These advancements not only improve tenant experiences but also increase property value and operational efficiency.There are numerous software tools that facilitate effective CRE asset management, including property management systems like Yardi and MRI, investment analysis platforms like CoStar, and tenant engagement applications. These tools simplify processes, streamline operations, and provide insights that drive strategic decision-making.

Real Estate Investment Strategies

Investors in commercial real estate have various strategies available to them, including value-added investments, core investments, and opportunistic investments. Each strategy has its own set of risk and return profiles.Luxury homes represent a unique investment opportunity with distinct advantages, such as high appreciation potential and exclusive clientele. However, they also come with risks, including market volatility and higher maintenance costs.

In recent years, traditional investment approaches have evolved, yielding modern strategies that focus on sustainability, technology integration, and tenant engagement. These modern methods appeal to a new generation of investors who seek both financial returns and social responsibility.

Current Real Estate Market Trends

The commercial real estate market is currently influenced by several key trends, including rising demand for flexible workspaces due to the shift towards remote work, increased interest in sustainable and green buildings, and the growth of e-commerce driving logistics real estate.Economic factors such as interest rates, inflation, and employment rates play a significant role in shaping real estate investment decisions.

Investors closely monitor these indicators to assess market conditions and adjust their strategies accordingly.Statistics reveal a robust luxury real estate market, with sales steadily increasing. Recent reports indicate that luxury home sales have surged by over 25% year-on-year in certain metropolitan areas, reflecting a growing demand for high-end properties.

Importance of Market Research in CRE

Market research is a foundational aspect of making informed investment decisions in real estate. It enables investors to understand market dynamics, buyer behavior, and competitive landscapes.Effective market research can be conducted through various methods, including surveys, demographic analysis, and trend monitoring. Utilizing technology, such as GIS mapping and data analytics, enhances the depth and accuracy of market insights.Case studies illustrate the success of thorough market analysis in asset management.

For instance, a comprehensive market study in a burgeoning urban area led to a successful investment in a mixed-use development, resulting in significant ROI due to well-informed decision-making.

Asset Management Best Practices

Implementing best practices in asset management is vital for maximizing the performance of commercial real estate investments. Key practices include regular performance reviews, proactive maintenance schedules, and tenant engagement initiatives. Sustainability and energy efficiency are increasingly important in property management, as they not only reduce operational costs but also align with tenant demands and regulatory requirements.Tenants play a significant role in asset value.

Building strong relationships with tenants through excellent service and communication can lead to higher retention rates and ultimately enhance the overall value of the property.

Future of CRE Lifecycle Asset Management

Emerging technologies, such as artificial intelligence, blockchain, and the Internet of Things, are set to reshape the future of asset management. These advancements promise increased efficiency, transparency, and improved decision-making capabilities.Potential regulatory changes could impact the real estate industry, particularly concerning sustainability and tenant rights. Staying informed about these changes will be critical for asset managers to navigate future challenges effectively.Adapting to changing consumer preferences in luxury real estate will also be essential.

As younger generations prioritize experiences and sustainability, properties must evolve to meet these demands, ensuring continued relevance and value in the market.

Final Summary

In conclusion, grasping the nuances of CRE lifecycle asset management equips investors and managers alike with the tools needed to thrive in a competitive landscape. As emerging technologies and market trends continue to shape the industry, staying informed and adaptable will be key to maximizing asset value and ensuring robust investment outcomes.

FAQ Section

What is the importance of technology in CRE asset management?

Technology enhances efficiency, improves decision-making, and enables better property management through data-driven insights.

How can sustainability impact asset value?

Sustainable practices can lead to reduced operational costs and increased tenant satisfaction, thereby enhancing asset value over time.

What are the risks associated with investing in luxury real estate?

Risks include market fluctuations, high maintenance costs, and varying demand, which can impact overall returns on investment.

Why is market research critical in real estate?

Market research informs investment decisions by providing insights into trends, pricing, and consumer preferences, reducing investment risks.

What role do tenant relations play in asset management?

Strong tenant relations can lead to higher occupancy rates and longer leases, directly contributing to increased property values.